Daniel T. Fink

Assistant Vice President,

Marketing and Client Service

As the market approaches year end, investors and pundits have renewed their focus on Federal Reserve (“Fed”) Chairman Jerome Powell. As volatility gripped markets throughout October, after Powell’s decidedly hawkish comments, more recent statements from the Fed have been enlightening. Chairman Powell’s speech this week in front of the New York Economic Council sent the markets surging. His decidedly dovish remarks struck a conciliatory tone about our proximity to the neutral rate, even expanding the spread of what could be considered the neutral rate, and was generally viewed positively by investors. Of course, along with Powell’s pronouncements comes increased focus on the flattening of the yield curve. With the 2s-10s spread smashed to below 25 basis points again, nervous nellies are dragging out their history books and furiously plotting charts that seem to point to a recession in our near future. Not to be outdone, proponents of the more obscure 1s-10s spread have been busy with their data, proudly proclaiming the superiority of their measurements as having less “false alarms” than the 2s-10s spread data. Are we looking at a false alarm? Cooler heads will of course remember that an inverted yield curve, no matter how one measures it, does not cause a recession. Sure, it may signal a recession could be imminent, but it is not the root cause. The mechanics of an inverted yield curve, higher short-term rates because of Fed policy, occur by the tightening of monetary policy. This tightening drives investors into longer-term bonds, showcasing a lack of confidence in short term economic growth. A tighter monetary supply slows growth, which in turn can lead to an eventual recession.

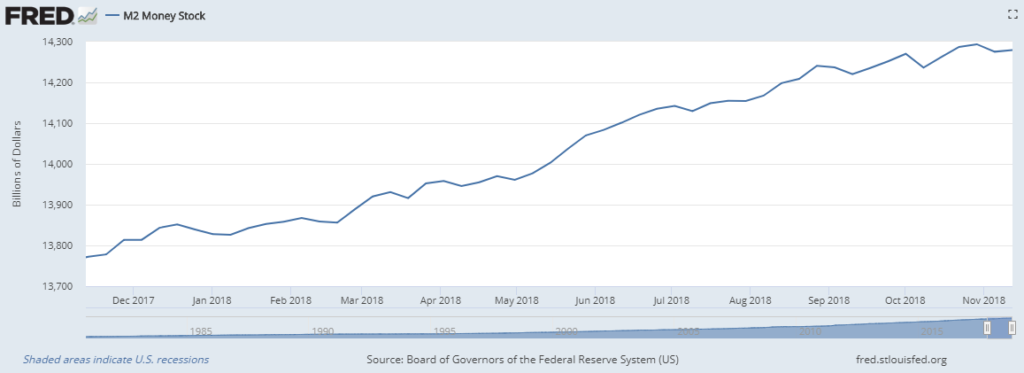

Is there another indicator to examine the possibility for when the party might end? Let’s take a look at the growth of M2, the money supply that includes M1 (cash and checking deposits) in addition to savings deposits, money market securities, as well as mutual funds. St. Louis FRED data shows that M2 has continued to grow over the last year; although the data is not conclusive.

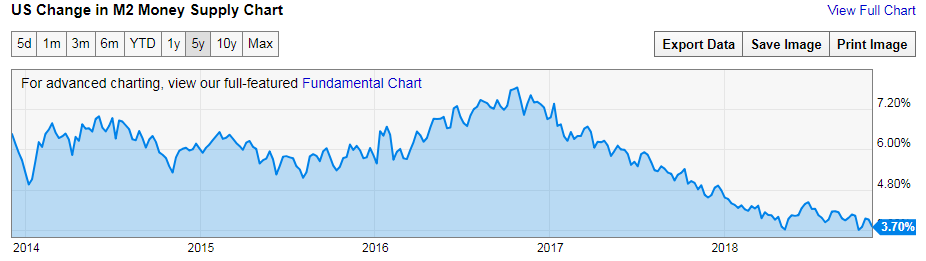

With the Fed unwinding its balance sheet, excess reserves are being removed from the banking system, reducing the annual seasonally adjusted growth rate of M2 to a mere 3.70% year-over-year for the week of November 5th. Worryingly, this represents a decline from the 3.90% rate last week and the 5.00% rate recorded for last year. Last year’s number is also lower than the long term average of 6.07%.*

History shows us with the Great Depression the POTENTIAL dangers of slowing money growth too much. The Fed will need to keep a careful watch. Embarking on a continued path of Fed Funds rate hikes along with continued balance sheet reduction is a form of “double” tightening of financial conditions, something not getting a lot of press and certainly something that investors should keep an eye on. If the Fed is not careful, it could find itself in a deflationary situation.

* https://ycharts.com/indicators/m2_money_supply_growth

Disclosures

|

Ziegler Capital Management, LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp. This material is based upon information that we consider reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. pinions expressed are our current opinions as of the date appearing on this material only. No part of this material may be duplicated or redistributed without Ziegler Capital Management’s prior written consent. All investments involve risk, including the possible loss of principal, and there is no guarantee that investment objectives will be met. Equity securities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Equity securities may rise and decline in value due to both real and perceived market and economic factors as well as general industry conditions. Indices are unmanaged, do not reflect fees and expenses, and are not available as direct investments. Past performance does not guarantee future results. |