Daniel T. Fink

Assistant Vice President,

Marketing and Client Service

The definition of mid caps can differ, depending on who you ask. Mid cap stocks are composed of U.S. companies in the middle capitalization range. This range is generally between $2 billion and $14 billion in market value. The spread is widely recognized as merely a guideline and not a hard and fast rule. The diverse number of mid cap stocks allow for a degree of selection and flexibility in portfolio construction.

When evaluating the performance of mid cap strategies, most utilize either the S&P 400 or the Russell Midcap Index. While both of these were designed to measure the performance of mid cap stocks, there are quite a few differences in their construction and emphasis. Here is how the S&P 400 and Russell Midcap Index differ.

The Russell Midcap Index is a collection of The 800 smallest company stocks of the Russell 1000, the large cap index. It is comprised of companies with market caps between $2 billion and $29 billion. The average Russell Midcap Index company has a market cap of $14. 1 billion, as one would expect given how the Russell 1000 uses the Midcap Index for its smallest 800 stocks. The index is reconstituted every June as part of the larger Russell rebalance.

The S&P 400 Index, as its name suggests, is a collection of 400 companies with market capitalizations between $1.6 billion and $6.8 billion. Like many other indices, the S&P 400 is a cap-weighted index, meaning that the largest stocks within the range have the largest impact. Currently the weighted-average market cap is around $5. 9 billion. The S&P 400 has members entering and leaving as the year goes along, with index constituents coming and going from the S&P 500 and S&P 600, as well as being taken out of the index due to being acquired.

The size differential is the most notable variation between the two indexes. The S&P 400 has a little more of a value bias, while the Russell Midcap Index has a higher cash flow growth profile and projected long-term earnings growth.

Mid cap companies can offer investors exposure to underfollowed names in the sweet spot of the corporate lifecycle. If small caps are the hare and large caps are the tortoise, imagine mid caps as the draft horse. While they might lack the household name brand recognition of large caps names, and while there certainly could be more unrealized appreciation potential in small cap names, mid caps often occupy what may be considered the sweet spot in the corporate lifecycle.

Generally speaking, mid cap companies have comfortably overcome much of the uncertainty and doubt that comes with being a small cap and are still nimble enough to potentially outmaneuver large cap names when it comes to generating vigorous growth. Large cap stocks oftentimes struggle to overcome their own gravity, and small cap names are riddled with uncertainty. Companies in the mid cap space typically have seasoned management teams, developed product lifecycles, broad distribution channels, and comfortable access to capital markets. Additionally, mid cap companies may be better positioned for dynamic growth than their large cap competitors, possess less time and energy supporting layers of corporate bureaucracy, and still pride themselves on their entrepreneurial spirit.

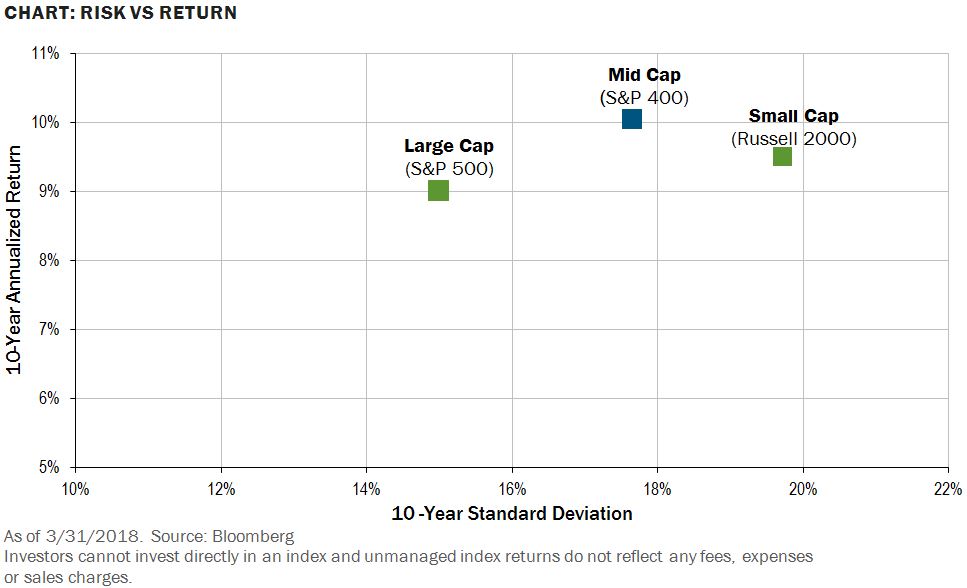

Over long investment horizons, the positive attributes of mid cap stocks may allow them to outperform large cap stocks with only slightly more volatility.

Mid cap names may outperform both the large and small cap indices while crucially remaining below the annualized standard deviation of small cap names. A smaller standard deviation, when coupled with a greater annualized return, may allow for a smoother ride and larger overall return throughout a market cycle.

While most mid cap stocks are not household names, the components that many of them produce are likely used by consumers every day. This attribute is what makes mid cap names special; they are uniquely positioned to scale through collaboration with other companies, potentially companies much larger than themselves, but who look to mid cap firms for the next great idea. From the computer chips in your cell phone to cutting-edge medicine, many of these successes have been brought about by companies that are firmly in the mid cap space. These companies often still possess a nimbleness to react to market opportunities, as well as concentrated focus on specific industry niches, qualities largely lacking from large cap names, to pursue continued innovation.

Ziegler Capital Management, LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp. This material is based upon information that we consider reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. pinions expressed are our current opinions as of the date appearing on this material only. No part of this material may be duplicated or redistributed without Ziegler Capital Management’s prior written consent. All investments involve risk, including the possible loss of principal, and there is no guarantee that investment objectives will be met. Equity securities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Equity securities may rise and decline in value due to both real and perceived market and economic factors as well as general industry conditions. Indices are unmanaged, do not reflect fees and expenses, and are not available as direct investments.